What is Self Insurance (aka Self-Funded Insurance)?

A self-funded health plan provides a variety of benefits. But what is self insurance?

In a self-funded benefit plan, an employer pays monthly fixed costs (administrative fees and premiums for stop loss administration) as well as the cost for members' medical claims. Claims costs vary based on plan utilization. Claims expenses are the largest portion of plan cost in a self-funded arrangement. A third party administrator should manage both plan cost and health care outcomes.

Employer health insurance and benefit plan solutions, products and services selected based on demographics, industry, group size, claims experience, plan design, risk tolerance, and variability in cash flow ensure a high-performing benefit plan that balances the bottom line and employee health and wellness.

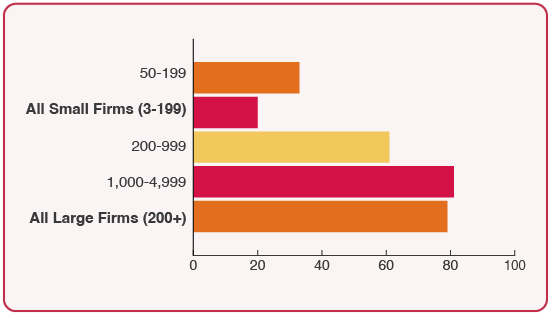

- Slide 1 - by firm size

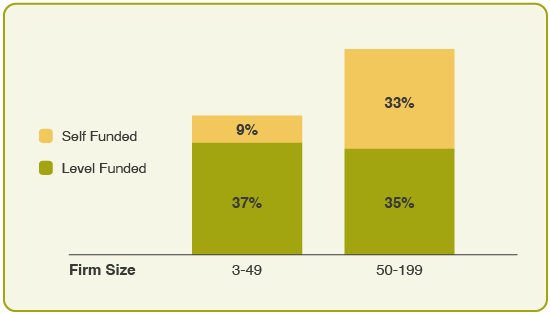

- Slide 2 - benefits for small firms

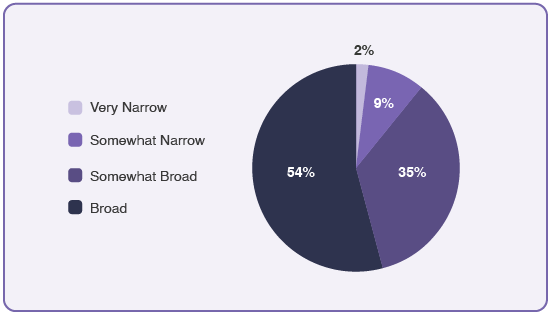

- Slide 3 - breadth of network

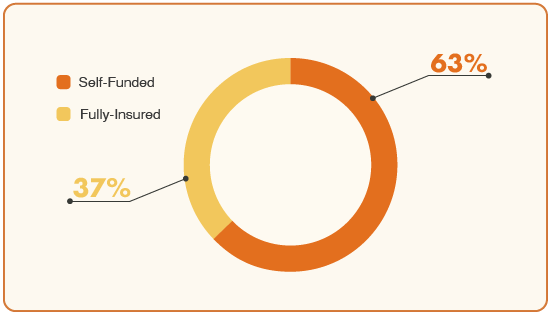

- Slide 4 - by plan type

Why Choose Self-Funding?

Self-insured plans allow your company the flexibility to design a plan that fits your unique needs and the opportunity to take greater control of your health care dollars. It's possible to provide quality employee benefits while also managing employee contributions and overall cost.

How do Self-Funded Plans Work?

Your situation is unique - your health plan solution should be too. Customize your benefit plan to meet the needs of your workforce by looking at geography, demographics and the variety of benefits offered. A self-funded plan’s flexibility starts with the right RFP questions - let us help.

Funding Options & Financial Risk

Fully-insured employee benefit plans apply a fixed monthly premium, regardless of utilization. Self-funded plans offer a pay-as-you-go approach, paying claims as they are incurred on a set schedule. It's helpful to understand the difference in plan funding when evaluating health plan options.

There's More to Self-Funding Than Saving on Administrative Costs

We aren’t just another third-party administrator — we’re part of your team.

We handle the administrative services you’d expect from a TPA including in-house medical management and plan analysis to mitigate financial risk and improve health plan trends.

And, you're not on your own to figure it all out. Nova embraces the flexibility a self-funded health plan provides, including partnerships with best-in-class vendors to help our clients maximize their plan performance. Watch the video to learn how self-funded benefits could benefit your business.

"From the beginning of our relationship with Nova, we have been impressed with the level of knowledge around self-funded health plans, stop loss insurance, reference based pricing, repricing vendors and general implementation."

- Ash Group, LLC